Trading Guides

Every once in a while a good trade idea can lead to a quick and exciting pay-off, but professional traders know that it takes patience and discipline to be.

Forex

[for-eks] –noun

- is a commonly used abbreviation for “foreign exchange”. It is typically used to describe trading in the foreign exchange market, especially by investors and speculators.

What is Forex? And Why Trade It?

You may not know it, but forex is actually one of the largest markets in the world, with over $4 trillion in average daily volume transacted.

This easily dwarfs the stock market. All the world’s stock markets combined average only about $84 billion per day.

So, if forex is so big, why have so few people heard of it?

The simple answer is you have probably used the forex market before, either directly or indirectly. Any time you take a trip to another country and exchange money, you just made a forex trade.

Whenever you buy something in a shop that was made in another country, you just made a forex trade. You paid in your own currency and the manufacturer was paid in a different currency.

"...you have probably already used the forex market before - directly or indirectly."

People trade currencies all the time, but how can currency be an investment? Here’s a simple example. Imagine that you took a trip from the United States to Europe in 2002. For the trip, you changed your US dollars into euros. At the end of a trip, you typically would change any extra euros back into US dollars. But what if you didn’t?

In 2002, one euro was worth about 90 US cents ($0.90). Say that you decided to hold on to 500 euros, and left them sitting in your desk drawer for 5 years. In 2007, you took your euros to the bank and sold them for a 2007 price of $1.40. Since you bought the euros for $0.90 and sold them for $1.40, you made a $0.50 profit per euro. You would have made $250 just because you held on to those euros and had bought and sold at the right time. That’s a 55% return in 5 years.

The $4 trillion forex market mostly runs on the same idea. Many of the world’s giant banks, hedge funds, and insurance companies actively trade currencies as a way to make money. Since they do so in very large amounts, they record profits and losses in the millions every day for the smallest fraction-of-a-cent movements in exchange rates.

Many have not heard of the forex market because the market has historically been largely exclusive to industry professionals. The average person could buy a stock but couldn’t trade currencies. So it remained solely in the hands of the big boys.

Things have changed

Like the online stock trading revolution of the 1990s, the Internet has brought forex trading within reach of the average person sitting at home.

Thousands of individual traders around the world can now trade currencies from their living rooms, with nothing but a computer, an Internet connection, and a small trading account.

You can now make trading and investment decisions to buy and sell British pounds or Japanese yen at any time, day or night (Sunday through Friday). This brief guide will show you how. But first, it’s important to know why you should trade forex.

Why Trade Forex?

Online forex trading has become very popular in the past decade because it offers traders several advantages.

- Forex never sleeps: Trading goes on all around the world during different countries' business hours. You can, therefore, trade major currencies any time, 24 hours per day, 5 days a week. Since there are no set exchange hours, it means that there is also something happening at almost any time of the day or night.

- Go long or short: Unlike many other financial markets, where it can be difficult to sell short, there are no limitations on shorting currencies. If you think a currency will go up, buy it. If you think it will fall, sell it. This means there is no such thing as a "bear market" in forex–you can make (or lose) money any time.

- Low Spread cost: Most forex accounts trade without a commission and there are no expensive exchange fees or data licenses. The cost of entering a trade is the spread between the buy price and the sell price, which is always displayed on your trading screen.

- Unmatched liquidity: Because forex is a $4 trillion a day market, with most trading concentrated in only a few currencies, there are always a lot of people trading. This makes it easier to get in to and out of trades at any time, even in large sizes.

- Available leverage: Because of the deep liquidity available in the forex market, you can trade forex with considerable leverage (Up to 1000:1). This can allow you to take advantage of even the smallest moves in the market. Leverage is a double-edged sword, of course, as it can significantly increase your losses as well as your gains.

- International exposure: As the world becomes more and more global, investors hunt for opportunities anywhere they can. If you want to take a broad opinion and invest in another country (or sell it short!), forex is an easy way to gain exposure while avoiding vagaries such as foreign securities laws and financial statements in other languages.

- So, let's start with what a basic forex trade looks like

Putting Your Ideas into Action

Currencies trade on an open market, just like stocks, bonds, computers, cars, and many other goods and services. A currency’s value will fluctuate depending on its supply and demand, just like anything else. If something increases supply or lowers demand for a currency, that currency will fall. For example, when Greece threatened to default on its debt, it threatened the existence of the euro, and investors around the world rushed to sell euros.

A currency's value will fluctuate depending on its supply and demand, just like anything else.

With a sudden dramatic rise in the number of euros for sale and a definite lack of demand for them, the euro dropped precipitously against the US dollar and other currencies.

The best thing about forex is that you can buy or sell at any time and in any order. So, if you think the eurozone is going to break apart, you can sell the euro and buy the dollar. If you think the Federal Reserve is printing too much money, you can sell the dollar and buy the euro.

The Bulls and the Bears

When looking at the future, many traders will have an opinion on where a currency is going. If a trader is optimistic and thinks a currency will rise, he is said to be “bullish”. If the trader is negative and expects a currency to fall, he is said to be “bearish”. Every day, the bulls and the bears do battle and the price moves as one or the other gets the upper hand.

Our job as forex traders is to look at the currencies available to us and to buy the strongest while selling the weakest. So, if after reading the news you became bearish of euros and bullish of US dollars, you could trade that opinion by selling euros and buying US dollars.

Reading a Quote and Making a Trade

Because you are always comparing one currency to another, forex is quoted in pairs. This may seem confusing at first, but it is actually pretty straightforward. Below is an example of a EUR/USD quote. It shows you how much one euro (EUR) is worth in US dollars (USD).

If you, instead, wanted to look at the euro in terms of the Japanese yen (JPY), you would look at the EUR/JPY rate. If you wanted to see the value of a US dollar in Canadian dollars (CAD), you would look at the USD/CAD.

The first currency in a currency pair is the “base currency”; the second currency is the “counter currency”. When you buy or sell a currency pair, you are performing that action on the base currency. So, if you are bearish of euros, you could sell EUR/USD. Now, when selling EUR/USD, you are not only selling euros, but are buying US dollars. If you are more bullish on the Japanese yen than you are on the US dollar, you could sell the EUR/JPY instead. It’s all up to you.

Let’s say that you sell EUR/USD at 1.4022. If the EUR/USD falls, that means the euro is getting weaker and the US dollar is getting stronger. Say the EUR/USD falls to 1.3522. In that case, you would have a profit. If it rose to 1.4522, you would have a loss. So just remember: if you sell a pair, down is good; if you buy the pair, up is good.

BUY EUR/USD at 1.4022

- Down = Loss

- Up = Profit

SELL EUR/USD at 1.4022

- Down = Profit

- Up = Losss

FOR EXAMPLE : 2 months ago

SELL EUR/USD

€1,000 x 1.4022 = $1,402.20

Now ——>

BUY EUR/USD

$1,402.20 / 1.3522 = €1,036.98

PROFIT/LOSS – €36.98 or $50.00

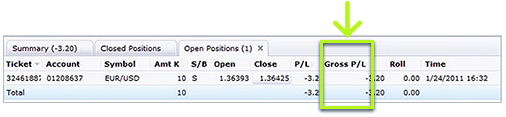

You can buy or sell anything you see active on your trading station, even if you don’t have any of that currency. When trading forex, you are speculating on the change in rates. You do this by borrowing the euros. This is standard for most forex traders. This also allows you access to leverage, which can increase your profits and your losses.

So, let’s look at the example again. When you sell EUR/USD, you borrow 1,000 euros and sell them to someone else in the market, earning the equivalent in US dollars. Say you did this while the EUR/USD is at 1.4022. In that case, you borrowed 1,000 euros, sold them for $1,402.20, and held on to those US dollars.

Two weeks later, you sold those US dollars when the rate was 1.3522. Since the EUR/USD price has fallen, you get more euros back at the end than you borrowed. So, you return the 1,000 euros you borrowed, and the remaining €36.98 is your profit to keep. If the price had risen to 1.4522 instead, that €36.98 would instead be a loss. Your trading station will do the math for you and apply the profit or loss directly to your account.

SO REMEMBER:

Buy currencies that are going up. Sell currencies that are going down.

Find the best pair to do that with.

Pips, Profit, Leverage, and Loss

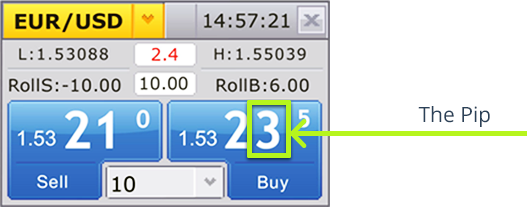

Over the years, professional forex traders have come up with some shorthand to make forex trading easier so you can quickly make decisions about your trading without needing to take out a calculator every time.

How Leverage Works

A pip is the unit you count profit or loss in. Most currency pairs, except Japanese yen pairs, are quoted to four decimal places. This fourth spot after the decimal point (at one 100th of a cent) is typically what one watches to count “pips”. Every point that place in the quote moves is 1 pip of movement. For example, if the EUR/USD rises from 1.4022 to 1.4027, the EUR/USD has risen 5 pips.

“Stock indices have ‘points’, futures have ‘ticks’, forex has pips.”

The monetary value of a pip can vary according to the size of your trade and the currency you are trading. JPPro demo accounts typically trade in increments or “lots” of 10,000. A pip in a standard demo account in EUR/USD is worth $1.00 per lot. If you were trading 3 lots, you would have 3 pips of profit or loss per pip the EUR/USD moves, and, therefore, $3.00 of profit or loss.

Some currency pairs will have different pip values.

FOR EXAMPLE: The EUR/JPY pips are valued in Japanese yen. USD/CAD pips are in Canadian dollars, and so on. Once again, your trading station makes it all easier by doing the math for you.

How Leverage Works

As mentioned before, all trades are executed using borrowed money. This allows you to take advantage of leverage. Leverage of 200:1 allows you to trade with $10,000 in the market by setting aside only $50 as a security deposit. This means that you can take advantage of even the smallest movements in currencies by controlling more money in the market than you have in your account.

While leverage can be advantageous in increasing your profits, it can also significantly increase your losses when trading, so it should be used with caution. Start trading in small sizes so that you don’t take on too much risk.

Leverage is a double-edged sword.

"Like with profit and loss, the trading station keeps track of margin for you."

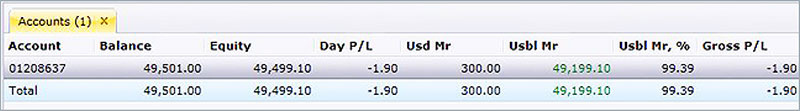

Used Margin (Usd Mr) is how much money you have set aside to secure your open trades. Usable Margin (Usbl Mr) is money left in your account to open new trades or to absorb losses. Always make sure that you have plenty of usable margin, otherwise you may get a margin call. If your usable margin gets low, you should close some trades or deposit money into your account.

How to Develop a Strategy

So, you now know what forex traders do all day ( and all night! ). Seems pretty simple, right? Buy rising currencies and sell falling ones.

What's Next?

You’ve already taken the first step by learning what forex is. Now it’s time to try it. Start with a demo account. It’s a free simulation of a real trading account. It has all the functions of a real account (streaming forex prices, pip, P/L, charts, etc.), but the money isn’t real. Think of it as test driving a car.

Becoming a Knowledgeable Forex Trader

Once on the demo, you’ll start to get a feel for how it all works. You can start buying the currencies you think will rise and selling the ones you think will fall.

But how do you know which currencies will rise and which will fall?

Over the years, forex traders have developed several methods for figuring out how far currencies will go.

- Fundamental Analysis: Since currencies trade in a market, you can look at supply and demand. This is called fundamental analysis. Interest rates, economic growth, employment, inflation, and political risk are all factors that can affect supply and demand for currencies.

- Technical Analysis: Price charts tell many stories and most forex traders depend on them in making their trading decisions. Charts can point out trends and important price points where traders can enter or exit the market, if you know how to read them.

- Money Management: An essential part of trading. All traders need to know how to measure their potential risks and rewards and use this to judge entries, exits, and trade size.

There are several important skills needed in order to become a forex trader. And like all skills, learning them takes a bit of time and practice. We have grouped all these needed skills together into an interactive trading course. You can learn how to analyze and trade the market from experienced instructors and traders. They teach using video-ondemand lessons and live office hours are available so you can get personal feedback, study on any schedule, and learn at your own pace.

And the best part is it’s free. All you need to do is show that you’re serious about getting into the world’s largest market. Open a live trading account with JPPro and you will become a real trader with real money. You’ll have unlimited free access to the course, as well as tool such as charts, research, and trading signals.